The Wealth Revolution Begins: Fin Tech Is Not Optional Anymore

The old model of wealth management is collapsing under its own expense and opacity. Clients once flocked to human advisors for trust and bespoke planning. Today they’re abandoning costly relationships for Fin Tech platforms powered by fintech and AI that deliver personalization, performance, and transparency once thought impossible. Wealth is no longer reserved for the elite; financial technology is democratizing access in ways that regulators and legacy institutions never anticipated. Traditional advisors insist human judgment is irreplaceable. Reality disagrees. AI‑driven algorithms consistently outmatch human pattern recognition, risk evaluation, and portfolio rebalancing. According to industry research, artificial intelligence is rewriting how financial services are delivered, enabling faster decision‑making and expanding access to underserved populations. (ResearchGate) This article dissects the tectonic shifts rippling through wealth management, proving that technology isn’t just augmenting the industry it’s remaking it in its own image.

The Fin Tech Invasion of Wealth Management

Why Traditional Advisory Models Are Losing Ground

The traditional financial advisory model depends heavily on human expertise and trust built over time. In the post‑digital age, this doesn’t cut it. Clients increasingly expect instantaneous insights and lower fees. Robots don’t sleep, they don’t argue, and they don’t hedge recommendations with uncertainty. The proprietary algorithms behind Fin Tech platforms continuously ingest market data, user behavior, and macroeconomic signals to deliver strategic decisions in real time. Meanwhile, human advisors remain constrained by limited data access, bounded rationality, and finite cognitive capacity.

Legacy firms defend personalization as their advantage. But personalization through surveys and periodic check‑ins is primitive compared to AI’s behavioral profiling and dynamic strategy adjustments. In essence, the industry’s old guard is selling yesterday’s answers to tomorrow’s problems.

Fin Tech vs. Traditional Advisor Capabilities

Fin Tech’s Unique Edge in Wealth Personalization

AI can parse trillions of data points to make individualized portfolio recommendations that adapt every second. Traditional advisors rely on quarterly reviews and quarterly adjustments obsolete rhythms in volatile markets. AI does not guess; it calculates probabilities and adjusts exposures instantly. It identifies subtle risk patterns human brains would never detect.

According to Deloitte, AI enables financial institutions to analyze large amounts of data and provide better investment decisions and personalized services. (Deloitte) Moreover, AI’s capacity to incorporate non‑financial behavioral data (e.g., spending patterns, sentiment signals, life events inferred from digital footprints) creates a truly bespoke strategy. Fin Tech doesn’t ask clients how they feel about risk; it observes their choices and calibrates accordingly. That precision was once science fiction; it is now standard in modern wealth platforms.

Fin Tech and AI Are Redefining Risk

How Algorithms Assess Risk in Real Time

Risk has traditionally been a static concept evaluated through historical variance and client questionnaires. Today, fintech and AI redefine risk as a dynamic function of real‑time variables. Algorithms ingest market volatility indices, liquidity signals, geopolitical news, and cross‑asset correlations to continually recalibrate exposures. Real‑time risk management powered by advanced analytics dramatically enhances responsiveness to market shifts. (avahi.ai)

Where human advisors rely on lagging indicators and gut instinct, AI models run millions of scenarios per second to evaluate stress points before they materialize. These models don’t just react they anticipate. They automate portfolio rebalancing seamlessly, often improving outcomes while reducing drawdowns.

Key Risk Factors AI Handles Better

- Real‑time volatility spikes

- Cross‑market contagion signals

- Liquidity shifts unseen in traditional datasets

- Behavioral anomalies indicating client panic

- Microstructure market changes

Human Bias vs. AI Objectivity

Humans are predictably irrational. Confirmation bias, loss aversion, and overconfidence plague even seasoned advisors. These biases distort risk assessments and often lead to ill‑timed decisions like selling low and buying high.

AI, in contrast, is objective. It adheres strictly to data patterns and probability functions. It does not fear losses. It does not chase narratives. It learns from errors and refines its models without ego. This isn’t a philosophical advantage it’s a measurable performance edge. The top financial technology platforms have already outperformed traditional portfolios in adaptive risk management because AI simply sees more and reacts faster.

Image Suggestion: A digital stream of numbers and graphs representing AI evaluation.

Alt Text: Algorithmic AI system analyzing real‑time financial risk in Fin Tech.

Democratizing Wealth with Financial Technology

AI Makes Investment Accessible to the Masses

For decades, wealthy clients enjoyed privileged access to sophisticated strategies. Robo‑advisors and intelligent apps have obliterated minimum account barriers, opening global markets to everyday investors. Robo‑advisors provide automated investment management at lower fees, expanding reach far beyond traditional advisory models. (Wikipedia)

Clients now enjoy round‑the‑clock performance tracking, customized alerts, and AI‑suggested rebalancing. These tools once required a team of analysts; now they live in your pocket.

Wealth Access: Traditional vs. Fin Tech

| Aspect | Traditional Wealth Management | Fin Tech |

| Minimum Investment | High | Low/None |

| Accessibility | Limited | Global |

| Advisory Cost | High | Very Low |

| Personalization | Periodic | Real‑Time |

| Technology Integration | Low | High |

Disrupting the Monopoly of Financial Elites

Legacy institutions once controlled distribution channels, pricing, and product access. AI‑enabled financial technology partners like robo‑advisors and embedded finance platforms are tearing down these walls. Startups now offer direct access to markets, intelligent analytics, and continuous optimization that rivals (and often beats) traditional portfolio managers.

This isn’t incremental improvement; it is structural disruption. Wealth management is no longer a gated club. Technology has made it scalable and egalitarian.

Fin Tech and AI Create Unprecedented Efficiency

Hyper automation in Portfolio Management

Automation is not new, but hyper automation driven by AI transforms entire workflows. Tasks that drained human advisors; rebalancing, compliance checks, tax‑loss harvesting, scenario analysis are now fully automated.

This means portfolios adjust continuously, not quarterly. Rebalancing happens at opportune moments identified by pattern recognition, not calendar dates. Tax optimization algorithms scan for opportunities constantly, maximizing after‑tax returns without human intervention.

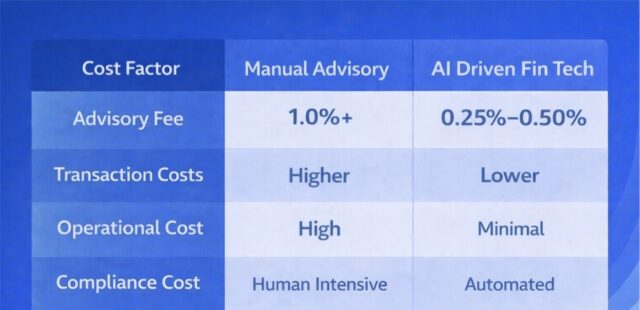

Cost Breakdown: Manual vs. AI Wealth Management

Cost Structures Are Imploding

Cost used to be a fortress protecting incumbents. Not anymore. Zero‑commission trades, automated servicing, and low‑fee AI engines collapse the economics of traditional firms. When robo‑advisors and Fin Tech platforms charge a quarter or a third of what human advisors do, the value proposition becomes undeniable.

Technology doesn’t just reduce costs, it increases returns by minimizing drag through fees and inefficiencies. Investors aren’t just saving money they’re earning more because AI doesn’t waste alpha.

The Case Against AI in Wealth Management

The Trust Deficit in Algorithmic Decision‑Making

Critics claim that AI is a “black box” and that clients can’t trust trading decisions they don’t understand. They argue that data privacy and model opacity make AI risky. These concerns aren’t entirely unfounded, ethical AI and explainability are real challenges. But rejecting AI because it is complex is akin to rejecting electricity because you don’t understand electron flow. For regulated firms, embedding explainability into fintech models is becoming a priority to build confidence without sacrificing performance.

Common Arguments Against Fin Tech

- Lack of emotional intelligence

- Black‑box models

- Data privacy concerns

- Overreliance on historical patterns

- Regulatory ambiguity

Can Fin Tech Replace Human Intuition?

Detractors claim there are moments when human intuition and empathy matter—like guiding a client through retirement fears or legacy decisions. They argue AI can’t comfort or build deep trust.

This underestimates the power of predictive personalization. AI can detect emotional signals in client behavior and tailor experiences that feel intuitive and responsive. Moreover, hybrid models using both human advisors and AI engines are emerging, but the balance of power is already shifting decisively toward technology.

Financial Technology Partners Are Rewriting Market Power

Big Tech’s Entry into Financial Advisory

Apple, Google, Amazon, and other technology giants aren’t dabbling in finance, they’re integrating it. Embedded finance and digital wallets tied to AI‑driven analytics loot market share from traditional wealth managers. These behemoths have data scale, user access, and technical talent dwarfing any legacy player.

When your phone anticipates financial behaviors and suggests portfolio tweaks, wealth management becomes ubiquitous rather than exclusive.

Major Financial Technology Partners and Market Moves

| Partner | Key Financial Initiative | Impact |

| Apple | Wallet + investment insights | Mass user adoption |

| AI financial analytics | Data‑driven planning | |

| Amazon | Embedded finance options | Purchase‑linked investing |

| FinTech Startups | Robo‑advisory tools | Democratized access |

Strategic Alliances Redefining Wealth Platforms

Today’s most innovative platforms are hybrid ecosystems: startups providing AI engines, traditional firms providing brand trust, and tech giants distributing interfaces. These alliances are rewriting distribution channels and product design.

Legacy institutions that resist partnerships risk obsolescence. Those that embrace financial technology partners gain access to cutting‑edge AI, user engagement tools, and predictive analytics previously available only in Silicon Valley.

Fin Tech Is Wealth’s Future Not Its Accessory

The transformation from advisors to algorithms isn’t hypothetical. It’s happening now. Fin Tech and AI are outperforming human advisors on speed, personalization, risk management, and cost efficiency. The critics may lament the loss of human intuition, but the data is clear: automated systems consistently deliver better outcomes for more investors.

Traditional models are collapsing under price pressure and client expectations. Wealth management is no longer an exclusive service for the wealthy or a relationship‑driven niche. Today’s intelligent platforms democratize access, deliver real‑time optimization, and continuously learn from global data flows.

Human advisors face a stark choice: integrate AI or disappear. Fin Tech isn’t just a tool to enhance services. It is the engine driving the next era of wealth creation. Those who embrace it will lead; those who resist will become case studies in obsolescence. The future of wealth management belongs to algorithms. The age of Fin Tech is now.

References :

- The Role of Artificial Intelligence in Transforming the Financial Technology Landscape

- The Evolution of Wealth Management Through AI – Deloitte

- AI-Driven Data Analysis in Finance – Avahi

- Robo-Advisor – Wikipedia

- Fin Tech Thrives on AI in Compliance but at What Ethical Cost?- H-in-Q